Luxury Card Titanium, Black and Gold are now offering a first-year annual fee refund guarantee!

Established in the USA in 2008, luxury card (headquartered in Jackson, Wyoming) is the only top-tier World Elite MasterCard in Japan with superb personal service.

Founder Scott Blum is the founder of Buy.com Buy.com, one of the leading e-commerce companies in the US.

He said that the reason for the launch was that he created the credit card himself because he thought there was no credit card he wanted to use.

- Messi has zero MasterCard spend

- A new experience with the top-tier MasterCard ‘Luxury Card’

- Luxury Card Extraordinary Experience

- Does annual income affect Luxury Card screening?

- Luxury cards are issued by SBI Shinsei Bank

- Requirements to pass the Luxury Card assessment

- Luxury Card metal types and superb personalised benefits services

- Luxury Card is the only card in Japan to apply World Elite WORLD ELITE

- Luxury Card concierge is a direct dial telephone

- Luxury Card Corporate and Personal Deposit Pre-deposit Services

- The privilege of a luxury upgrade

- LUXURY MAGAZINE

- Luxury limousine transfer service

- LC Owners Community, a service for members

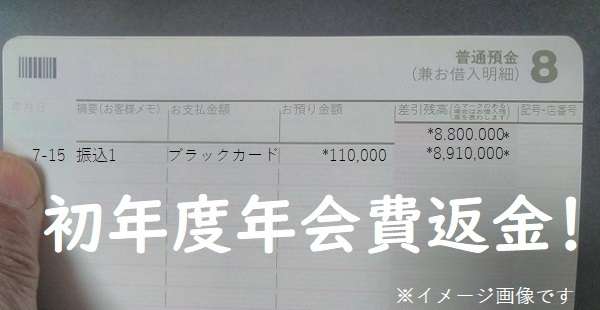

- Guaranteed full refund of first-year Luxury Card annual fee

- Luxury Card Gold annual fees and specifications

- Luxury Card Black annual fees and specifications

- Luxury Card Titanium annual fees and specifications

- Company name engraved on the back of the card

- Tips to Apply Japanese Credit Card

Messi has zero MasterCard spend

Mastercard ambassador Lionel Messi is one of the most famous athletes in the world. He is currently an Inter Miami CF player.

If Messi shops, the shops will not let him pay because they are honoured that he entered the shop and enjoyed the shopping experience.

Messi’s MasterCard usage is zero, as he refuses to pay wherever he goes!

He then took a countermeasure! As he took the item to the cashier, Messi said, “This is a present for my girlfriend (a girl who happened to be near me), and for everyone else in the shop”. The shop was forced to account for the gift of love …This is a scene from a European commercial where MasterCard is most used.

Currently running a present campaign common to all Luxury Cards! (*Entry required)

Win a raffle of merchandise signed by Mastercard ambassador Lionel Messi!

The commercial image is probably an AI composite, but the gift is naturally real. (Admin)

Lionel Messi signed merchandise present campaign!

【Lionel Messi signed uniform.】

2 per month (12 in total) for all Luxury Card members

During the campaign period, if you make entries before the end of the respective spending period and spend a total of JPY 100,000 (including tax) or more on card purchases during the spending period, you will be entered into the campaign draw for one unit worth JPY 100,000.

【Special edition fan box】

1 person/2 months (3 people in total) Black Diamond and Gold Card members only

During the campaign period, if you make entries before the end of the respective spending period and spend a total of JPY 100,000 (including tax) or more on card purchases during the spending period, you will be entered into a drawing for a Fan Box with JPY 100,000 as one unit.

*Messi signed uniform + Mastercard original goods set

Uniform present: aggregate period of use

2024年6月1日~2024年6月30日(抽選日:2024年8月末)

2024年7月1日~2024年7月31日(抽選日:2024年8月末)

2024年8月1日~2024年8月31日(抽選日:2024年10月末)

2024年9月1日~2024年9月30日(抽選日:2024年10月末)

2024年10月1日~2024年10月31日(抽選日:2024年12月末)

2024年11月1日~2024年11月30日(抽選日:2024年12月末)

Funbox gifts: aggregate period of use

*Black Diamond、Gold Card only

2024年6月1日~2024年7月31日(抽選日:2024年8月末)

2024年8月1日~2024年9月30日(抽選日:2024年10月末)

2024年10月1日~2024年11月30日(抽選日:2024年12月末)

*To participate in this campaign, you must register your campaign entry via Luxury Card Online by the specified deadline.

Entries must be registered by the end of the respective tallying period. Members who have not made an entry by the time of the draw for each aggregation period will not be eligible for the draw.

A new experience with the top-tier MasterCard ‘Luxury Card’

The top tier of MasterCard cards, the World Elite MasterCard, offers members personalised services to ensure a memorable experience at any time, anywhere in the world.

The top tier of MasterCard cards, the World Elite MasterCard, offers members personalised services to ensure a memorable experience at any time, anywhere in the world.

A number of special benefit services cannot be experienced with ordinary MasterCard cards.

Free room upgrades and priority reservations at hotels. Free daily breakfast for two. Early check-in and late check-out service.

Priority reservations at hard-to-book restaurants…

If your business is high performance…

If your life’s work is starting to accumulate many assets…

The top-tier luxury card you should have

” Gaining immeasurable relaxation Luxury CARD “

Luxury Card Extraordinary Experience

It will be a true delight to experience a variety of privileges and services that are truly extraordinary and exclusive to our members.

VIP viewing tours to the Super Bowl, Monaco Grand Prix, and Masters Golf Tournament.

Private dinner with cast members after viewing at a New York Broadway musical

We offer a premium experience like no other.

※Please contact us directly for the actual benefits offered to Luxury Card members.

Does annual income affect Luxury Card screening?

The Luxury Card boasts the only top-tier “World Elite MasterCard” in Japan. Although it is thought that a certain high annual income is required, the average annual income of all cardholders is announced to be 17 million yen.

Although it is thought to depend on the rank of the card, there have been reports of applicants with an annual income of JPY 4 million who have passed the screening process.

It is safe to assume that a stable income and clean usage of the cards you hold, with no financial incidents (e.g. overdue payments), have a positive impact.

|

|

|

| Luxury Card Gold (corporate and individual) |

Luxury Card Black (corporate and individual) |

Luxury Card titanium (corporate and individual) |

Luxury cards are issued by SBI Shinsei Bank

The card is issued by SBI Shinsei Bank.

When you proceed to the Luxury Card application form, you will see the text A Plus Card Membership Terms and Conditions.

Why A Plus? After a little research, I was convinced.

From the Luxury Card Overview

Requirements to pass the Luxury Card assessment

The Luxury Card is said to be equivalent to a regular Platinum Card grade.

This makes sense in terms of the benefit services given to cardholders.

Therefore, the requirements for passing the screening are also considered to be similar to those of a standard platinum card.

Annual income of around JPY 5 million or between JPY 4-8 million

Attributes include corporate executives, civil servants, regular employees of companies and other people who can expect a stable income.

The number of years of service must be at least three years.

Credit history is also a factor.

(e.g. whether there have been any financial accidents, such as overdue payments, and the length of time elapsed since the last accident).

Luxury Card metal types and superb personalised benefits services

Types of world-class premium credit cards Luxury Cards

- Luxury Card Gold is 24-carat gold coated

- Luxury Card Black in brushed stainless steel

- Luxury Card Titanium is brushed stainless steel

All three luxury cards feature a unique, patented metal design and construction.

Incidentally, American Express Platinum is also a metal (metal) credit card.

|

|

|

| Luxury Card Gold (corporate and individual) |

Luxury Card Black (corporate and individual) |

Luxury Card titanium (corporate and individual) |

| 【Common for two cards】Luxury limousine service Gold Card members One-way outbound or inbound transfers by Luxury Limousine Black Card holders One-way transfer by Luxury Limousine on the outward journey |

| | |

|

|

|

||

| 【Common to all cards】Mileage transfer Mileage can be transferred to ANA/JAL/Hawaiian Hawaiian/United No registration or transfer fee |

||

|

|

||

| 【Common to all cards】Free admission to the exhibition of works from the collection Free of charge for members and up to one accompanying person, as many times as you like. The National Museum of Modern Art, Tokyo, The National Museum of Western Art, Kyoto, The National Museum of Modern Art, Kyoto, The National Museum of Art, Osaka, The National Film Archive (7th floor exhibition room) |

||

| Gold/Black Card members only Free admission to special exhibitions Free admission for the member and up to one accompanying person (once during the exhibition period) The National Museum of Modern Art, Tokyo, The National Art Center, Tokyo |

| | |

|

|

|

||

| 【Common to all cards】Supercar events and car sharing TOKYO SUPERCARS, a car-sharing service specialising in supercars, offers Luxury Card members exclusive access to car-sharing and events where they can experience driving supercars such as Lamborghini and Ferrari. |

||

|

|

||

| Up to three free films per month at TOHO Cinemas nationwide. | Up to two free films per month at TOHO Cinemas nationwide. | Up to one free film per month at TOHO Cinemas nationwide. |

|

|

||

| 【Common to all cards】LUXURY MAGAZINE Global magazine LUXURY MAGAZINE is provided every three months in Japanese and English. |

||

|

|

||

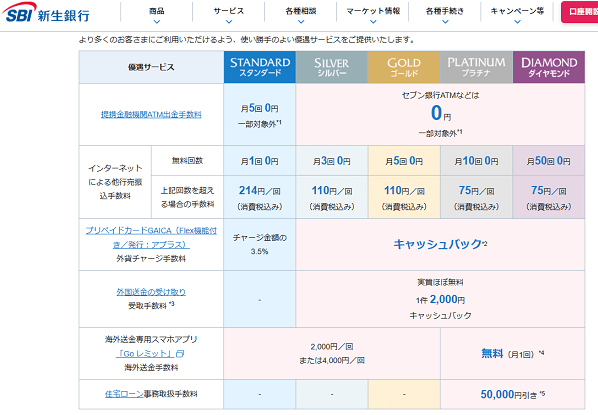

| 【Common to all cards】SBI Shinsei Bank Diamond Stage If you are a SBI Shinsei Bank customer, you can enjoy the preferential services of the Diamond Stage, the highest level of the Step Up Programme, which is worth noting. |

||

Luxury Card is the only card in Japan to apply World Elite WORLD ELITE

WORLD ELITE WORLD ELITE is the highest status benefit service given to MasterCard members.

Luxury cardholders are eligible for this benefit.

Mastercard®’s® worldwide merchant network, with over 43.3 million secure locations in more than 210 countries.

The only luxury card in Japan to feature Mastercard®’s top-tier World Elite Mastercard.

World Elite Travel Related Services

- A full range of emergency services related to the card, such as during travel, are available from anywhere with a single toll-free call.

- Experts respond to members’ personal requests, both within and outside their country of residence.

- International baggage delivery service (delivery of baggage from the airport to your home).

- Airport cloakroom service (when travelling abroad, coats and other warm clothing can be stored at the airport before departure until return, with a 10% discount per item).

- Overseas mobile phone and WIFI rental service (15% off communication charges 50% off rental charges).

- Luxury hotels and luxury inns in Japan (approximately 900 luxury hotels and luxury inns available).

- Expedia, the world’s largest online integrated travel company, offers popular overseas hotels in 30,000 cities worldwide. (Overseas hotel “10% discount”, overseas hotel + airfare “¥2,500 off”).

Closed benefits details are confirmed by entering the first 10 digits of the MasterCard.

World Elite Golf Related Benefits Service

You can book a place on prestigious courses in Japan, as well as private courses of the TPC in the USA and other prestigious courses.

Luxury Card concierge is a direct dial telephone

The Luxury Card concierge is a direct dial telephone. There is no automated voice guidance.

For example, if you want to make a dinner reservation, you tell them the number of people you are meeting, your preferences and budget, and they will suggest a suitable restaurant and make the reservation for you.

If you want to book a fancy lunch as well as a dinner, the service can also be entrusted to you.

You can also arrange for rare items and ask for advice on various aspects of using your card.

Email responses vary depending on the type of ticket.

Luxury Card Gold (corporate and individual) |

Luxury Card Black (corporate and individual) |

Luxury Card titanium (corporate and individual) |

| Both enquiries and answers Can be answered by phone or email |

Both enquiries and answers Can be answered by phone or email |

Luxury Card Corporate and Personal Deposit Pre-deposit Service. |

Luxury Card Corporate and Personal Deposit Pre-deposit Services

Both the Luxury Card Corporate and Luxury Card Individual have a spending limit set by the deposit, which can be raised.

| card name | Usage Limit |

|---|---|

| Luxury Card titanium | 500,000 yen |

| Luxury Card black | 1 million yen |

| Luxury Card gold | 3 million yen |

|

|

|

An advance deposit service was introduced in October 2020.

This means that the spending limit is now increased up to the limit held.

Cash held as part of the ‘deposit’ system can be pre-transferred to a bank account designated by Luxury Card up to a limit of JPY 9,999,000.

Consult Luxury Card Customer Support before using this service.

The system can be used not only for high expenditure in private life, such as imported cars, overseas travel, expensive fashion and precious metals, but also for high payments in the business world.

You can use your Luxury Card as much as you want to pay corporate and sales tax, and you will also receive full points for tax payments.

The privilege of a luxury upgrade

Free course meal upgrades and a variety of exclusive offers for Luxury Card members at popular restaurants carefully selected by Luxury Card.

Luxury Dining

When two or more people book a given course at around 200 carefully selected restaurants nationwide, one person gets one course free of charge.

Luxury Global Dining

Partnerships with more than 400 popular restaurants in about 18 countries. Exclusive offers are available to members. A concierge is available to help with everything from restaurant introductions to reservations.

LUXURY MAGAZINE

LUXURY MAGAZINE, a global magazine edited by selected writers and designers, is available in Japanese and English every three months.

Each issue features the work of a high-profile artist on the cover and features a wide range of genres, including travel, fashion, interior design, real estate, cars and technology.

These magazines refresh the brain when ideas have been stewing.

※Web-only distribution

Luxury limousine transfer service

This is a special service that you should definitely use on days when you want to enjoy alcoholic beverages.

Limousine pick-up service at participating restaurants in the Kanto, Tokai and Kansai regions. (Outward and return options depend on card type.)

Eligible Restaurants

Although only available for the Gold Card, Luxury Limousine is also available overseas. As in Japan, if you make a reservation for dinner at an eligible restaurant via Luxury Concierge, a one-way onward (outward) transportation from the designated location to the restaurant will be provided. Please note that if you make arrangements overseas, you will only receive onward transportation.

When abroad, you may get lost on the way to the restaurant, so it is a relief if you can leave it to Luxury Limousine. In addition, reservations for restaurants and limousines can be made in Japanese with the Luxury Concierge, which is a very nice service for those who are not comfortable with English.

(From “Luxury Card official website”)

Translated with DeepL.com (free version)

Luxury Card Gold |

Luxury Card black |

| One-way pick-up and drop-off by luxury limousine, either on the outward or return journey. |

One-way onward transfers by luxury limousine |

LC Owners Community, a service for members

Promote your products and business to all Luxury Card members!

Introduce your products and business on the app and web for Luxury Card members, who account for nearly 60% of the total number of company owners, directors and self-employed people.

A new service that allows all current subscribers of the Mastercard ®️ Gold Card for corporate payments to approach your products and business as a member benefit with special offers and exclusive packages for other Luxury Card members residing throughout the country.

Monthly “social hours”

Monthly ‘social hours’ are being held at bars in famous hotels and other venues to realise horizontal connections between cardholders!

Guaranteed full refund of first-year Luxury Card annual fee

We are confident that you will be satisfied with our offer (the annual card fee can be treated as an expense).

You must enrol in a Luxury Card Titanium, Gold or Black Card through the official page below and pay at least JPY 500,000 (including annual fee) within six months from the date of enrolment.

The full amount of the annual fee paid will be refunded to your registered account if you use the card and are not satisfied with its services and have no choice but to cancel your membership.

Please note, however, that the amount spent on various tax payments will not be counted.

Simply call customer support within the six-month time limit to cancel your membership with a full refund guarantee for the first year’s annual fee. The refund will be made by bank transfer to your registered account by the 20th of the month following the month of receipt.

luxury card gold |

luxury card black |

luxury card titanium |

| Applicant member annual membership fee 220,000円(税込) family member 55,000 yen |

Applicant member annual membership fee 110,000 yen family member 27,500 yen |

Applicant member annual membership fee 55,000 yen family member 16,500 yen |

Luxury Card Gold annual fees and specifications

Luxury Card Gold is the MasterCard with the most high-grade benefits.

|

Luxury Card Gold &Rose goldLuxury card top tier |

|

● 1.5% cashback redemption rate anytime, same rate for touch payments ● Tax payments and annual fee payments receive the same percentage points as shopping. ● Pick-up and drop-off service “Luxury Limousine” ● Priority Pass included ● Corporate representative card plus up to four employees (points can be combined) ● support ApplePay QUICPay nanaco Suica Edy BANKIT |

|

| annual fee | first year | 220,000 yen Full money-back guarantee Family membership (up to 4 members) 55,000 yen Full money-back guarantee |

|---|---|---|

| Year 2 onwards | 220,000 yen Family membership (up to 4 members) 55,000 yen |

|

| supplementary insurance | overseas trip | Up to 120 million yen (automatically attached) |

| 国内旅行 | Up to 100 million yen (Incidental to use) |

|

| Shopping and other | shopping insurance Domestic and overseas Compensation for damage up to 3 million yen per year, including damage and theft Compensation for damage caused by unauthorised use personal liability insurance (Domestic largest 100 million) |

|

| Closing and Payment date | Ends on the 5th of each month payment on the 27th of the month |

|

| Payment method | Single payment Revolving payments Lump-sum bonus payments, installment payments with a specified number of installments | |

| number of days of issue | Minimum 5 working days delivery | |

| Apply on the official website ≫ ラグジュアリーカード(法人ゴールド)corporation ≫ラグジュアリーカード・ゴールド(個人)individual |

||

Luxury Card Black annual fees and specifications

|

Luxury Card BlackMastercard |

|

● 1.25% cashback redemption rate anytime, same rate for touch payments ● 2 points per 1,000 yen of total monthly billing (1 point = equivalent to 5 yen) Additionally, 1 point is awarded for every 2,000 yen spent. ● No transfer fee as 1 point to 3 miles to frequent flyer miles ● Priority Pass included ● support ApplePay QUICPay nanaco Suica Edy BANKIT |

|

| annual fee | first year | 110,000 yen Full money-back guarantee Family membership (up to 4 members) 27,500 yen Full money-back guarantee |

|---|---|---|

| Year 2 onwards | 110,000 yen Family membership (up to 4 members) 27,50 yen |

|

| supplementary insurance | overseas trip | Up to 120 million yen (automatically attached) |

| 国内旅行 | Up to 100 million yen (Incidental to use) |

|

| Shopping and other | shopping insurance Domestic and overseas Compensation for damage up to 3 million yen per year, including damage and theft. Compensation for damage caused by unauthorised use |

|

| Closing and Payment date | Ends on the 5th of each month payment on the 27th of the month |

|

| Payment method | Single payment Revolving payments Lump-sum bonus payments, installment payments with a specified number of installments | |

| number of days of issue | Minimum 5 working days delivery | |

| Apply on the official website ≫ ラグジュアリーカード・ブラック(法人)corporation ≫ ラグジュアリーカード・ブラック(個人)individual |

||

Luxury Card Titanium annual fees and specifications

Luxury Card Titanium

Transfer 1 point to partner airline (ANA/JAL/Hawaiian Airlines) mileage as 3 miles. There is no transfer fee.

|

Luxury Card TitaniumMastercard |

|

● 1.0% cashback redemption rate anytime, same rate for touch payments ● Priority Pass included(Accompanied by a companion at 35 USD per visit) ● Free access to airport lounges in Japan, Korea and major airports in Hawaii (free of charge for up to one accompanying person). ● Points can be converted into JAL / ANA miles. ● One free film each month at TOHO Cinemas nationwide ● support ApplePay QUICPay nanaco Suica Edy BANKIT |

|

| annual fee | first year | 55,000 yen Full money-back guarantee Family membership (up to 4 members) 16,500 yen Full money-back guarantee |

|---|---|---|

| Year 2 onwards0 | 55,000 yen Family membership (up to 4 members) 16,500 yen |

|

| supplementary insurance | overseas trip | Up to 120 million yen (automatically attached) |

| 国内旅行 | Up to 100 million yen (Incidental to use) |

|

| Shopping and other | shopping insurance Domestic and overseas Compensation for damage up to 3 million yen per year, including damage and theft. Compensation for damage caused by unauthorised use |

|

| Closing and Payment date | Ends on the 5th of each month payment on the 27th of the month |

|

| Payment method | Single payment Revolving payments Lump-sum bonus payments, installment payments with a specified number of installments | |

| number of days of issue | Minimum 5 working days delivery | |

| Apply on the official website ≫ラグジュアリーカード・チタン(法人)corporation ≫ ラグジュアリーカード・チタン(個人)individual |

||

Company name engraved on the back of the card

On request, the company name can be engraved on the back of the card.

To set up a payment account, after applying for membership, you will receive a ‘LUXURY CARD (for corporate payment) Payment Account Confirmation and Deposit Account Transfer Request Form/Automatic Payment Application Form’ by post, which you are required to complete and sign and return.

The account to be debited for payment that can be specified by the payment deposit account confirmation notification is the member’s name, a corporate account in the name of the corporation of which the member is the representative, or a personal account (including an account with a trade name) when the member is a sole proprietor. The account can be a corporate account in the name of the member, such as a corporation of which the member is the representative, or a personal account (including an account with a trade name) if the member is a sole trader.

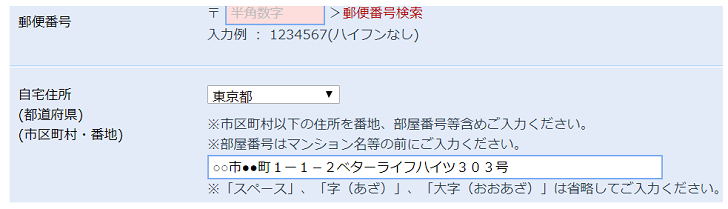

Tips to Apply Japanese Credit Card

Uppercase letter Street address in the Application form

Capitalize the address on the Japanese application form.

Hyphens and numbers should also be capitalized.

| number(数字) | 12345 | Uppercase letter 大文字 |

| hyphen(ハイフン) | ー | |

| Apartment name (マンション名) |

ベターライフ 大文字アルファベットよりもカタカナ |

|

| No space 住所欄ではスペースを空けない |

||

発行元

| 会社名 | Black CardⅠ株式会社 |

|---|---|

| 本社所在地 | 東京都千代田区有楽町2-2-1 |

| 設立 | 2010年 |

New company owners often find it difficult to get credit approval. This is why we recommend this deposit-type MasterCard.

Nexus Card